Net Operating Income

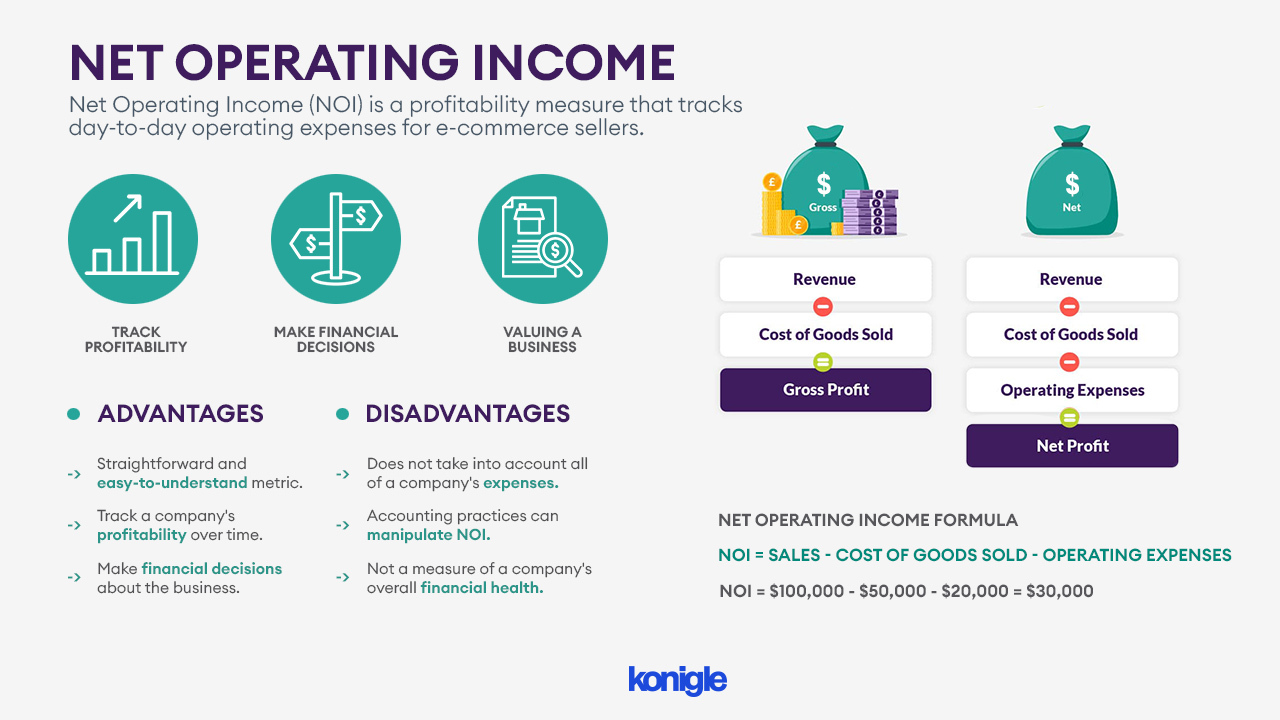

Net Operating Income (NOI) is a profitability measure that tracks day-to-day operating expenses for e-commerce sellers. It is calculated by subtracting the cost of goods sold and operating expenses from sales.

Net Operating Income (NOI) is a profitability measure that takes into account all operating expenses but excludes interest, taxes, depreciation, and amortization (EBITDA).

For e-commerce sellers, NOI can be a useful metric to assess their business's financial health.

Why is NOI Important for E-commerce Sellers?

NOI is important for e-commerce sellers because it can help them to:

- Track profitability: NOI can help you track your business's profitability by considering all operational expenses. You can use this information to identify areas where the business can become more profitable.

- Make financial decisions: NOI can be utilized to make financial decisions for the business. This includes decisions such as whether to expand, invest in new equipment, or take on debt.

- Valuing a business: NOI can be useful for valuing a business, especially if the owner is thinking about selling it.

Net Operating Income vs Net Income

Net income is a more comprehensive measure of a company's profitability compared to NOI. This is because net income includes all of a company's expenses, such as interest, taxes, depreciation, and amortization, while NOI does not factor in those expenses.

The primary difference between NOI and net income is that NOI measures a company's operating profitability, while net income measures a company's overall profitability.

If you're an e-commerce seller, it might be more useful for you to focus on NOI as a metric because it hones in on expenses that are directly related to the day-to-day operations of your business.

Net Operating Income Formula

The formula for calculating NOI is as follows:

NOI = Sales - Cost of goods sold - Operating expenses

- Sales: The total revenue generated by the business.

- Cost of goods sold: The cost of the goods or services that the business sells.

- Operating expenses: The expenses incurred in running the day-to-day operations of the business, such as rent, utilities, and salaries.

Net Operating Income Example

Assuming an e-commerce seller has the following income and expenses for the year:

- Sales: $100,000

- Cost of goods sold: $50,000

- Operating expenses: $20,000

The seller's NOI (Net Operating Income) would be calculated as follows:

NOI = Sales - Cost of goods sold - Operating expenses = $100,000 - $50,000 - $20,000 = $30,000

In this example, the seller's NOI is $30,000. This means that the seller is making a profit of $30,000 after taking into account all of their operating expenses.

Advantages of Net Operating Income

- Net Operating Income (NOI) is a straightforward and easy-to-understand metric.

- It can be used to track a company's profitability over time.

- NOI can be leveraged to make financial decisions about the business.

- NOI can be used to determine the value of a business.

Disadvantages of Net Operating Income

- Net Operating Income (NOI) does not take into account all of a company's expenses.

- Accounting practices can manipulate NOI.

- NOI is not a measure of a company's overall financial health.

Overall, Net Operating Income (NOI) is a useful metric for e-commerce sellers to track their profitability and make financial decisions. However, it is important to be aware of its limitations.