Profit Margin

Profit margin is the difference between the total cost to run your online store and the total revenue it brings in. It is one of the most commonly used profitability ratios to measure how much money a company or business is making.

Profit margins are how much money you are making with your business. Profit margin calculates and measures your business profitability with this you also know whether you are actually making a good amount of money from your business or not.

It also represents your business or company's net income when divided by revenue.

When you sell something to your customers the amount you get is the whole amount of your product or services. when you subtract the company’s expenses from its total revenue you will get a profit margin.

To get the exact amount of profit margin you directly put your values in the formula.

Why is profit margin important?

Profit margins are significant because you need to know how your business is performing and how much direct profit you get from the revenue.

Sometimes when starting any business you set a Profit margin but day by day if you grow automatically your expenses increase multiple will get added to your business that time you need to understand if you do not reduce expenses or increase the selling price your business will get stuck or lose financially.

If you understand and always calculate the profit margins you get an idea of which services or products give you less revenue or you know when your expenses increase and how you manage them to get more profit.

How do we calculate profit margin?

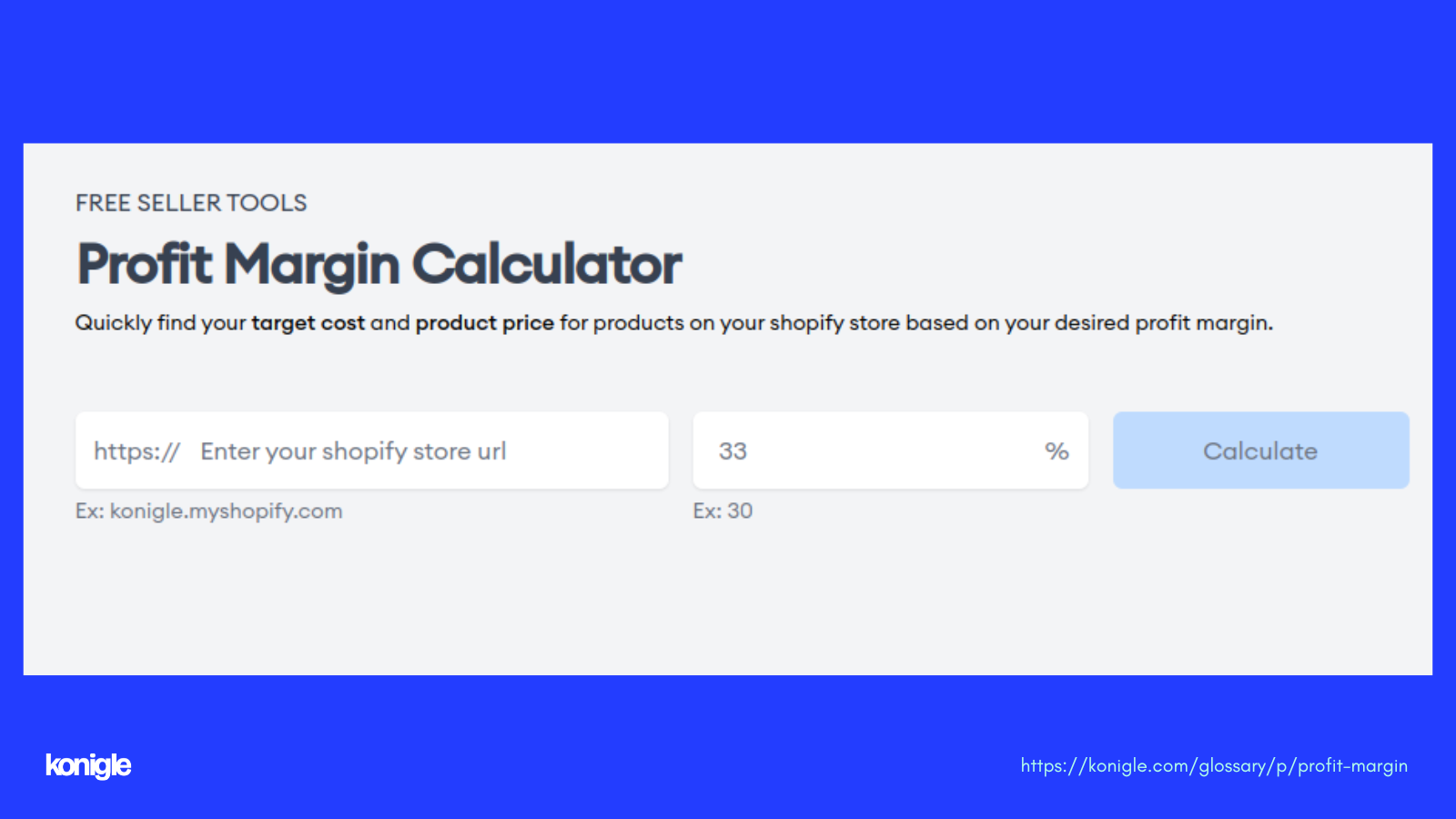

With the help of the Gross, Operating, and Net Profit margins formula you can easily calculate the profit margins. Also Using Konigle's Profit Margin Calculator, you can quickly find your target cost and product price for products on your Shopify store based on your desired profit margin.

1. What is a gross profit margin

Gross profit margin is the simplest and most used metric because it defines the profits of all income that remains after accounting for the COGS (cost of goods sold). This includes only those expenses that directly come with the production or manufacturing unit of the item it includes raw materials and wages for labor.

This Excluded other things like any expenses for debt, taxes, and one-time costs such as equipment purchases. The gross profit margin is your overall revenue minus the cost of goods.

Formula to calculate gross profit margin:

Gross profit margin = Revenue - COGS/ Revenue * 100

2. What is an operating profit margin?

Operating Profit Margin metric for operating costs, administrative costs, and sales expenses. It contains amortization rates and asset depreciation but Operating Profit does not include taxes, debts, and other executive-level costs. operating slightly more complex than gross margin.

Operating Profit tracks necessary metrics to run operating, administrative, and sales expenses of the business day-by-day basis.

Formula to calculate operating profit margin:

Operating Profit = Operating income / Revenue * 100

3. What is a net profit margin?

Net profit margin is the most difficult and complex type of profit margin to track but it gives you the most insight into your bottom line of business.

They track all ll expenses and income from other sources such as investments while setting up a business or running a business.

Formula to calculate net profit margin:

Net profit margin = Revenue - Cost / Revenue * 100

or

Net Profit margin = Net Profit / Total revenue * 100