Margin

Margin is the price difference between a product purchased by retailers to sell and the price a customer pays for the same product. The higher this figure the better it is for your business.

Margin is the profit generated after calculating all costs, which is expressed as a percentage. In short, it's an overall difference between generated revenue and expenses of items.

After buying items from the manufacturer or supplier for resale in your store, you must calculate the margin carefully for selling to customers.

Example of Margin

For example, If you have an online store and purchase an item from a manufacturer or supplier for $50 and sell it to your customer for $75. Then the gross margin of that item is 50 percent.

The higher the margins, the better it is for your business, but you should be cognizant of value-based pricing to price your products well and maximize profits, as well as provide a great customer experience.

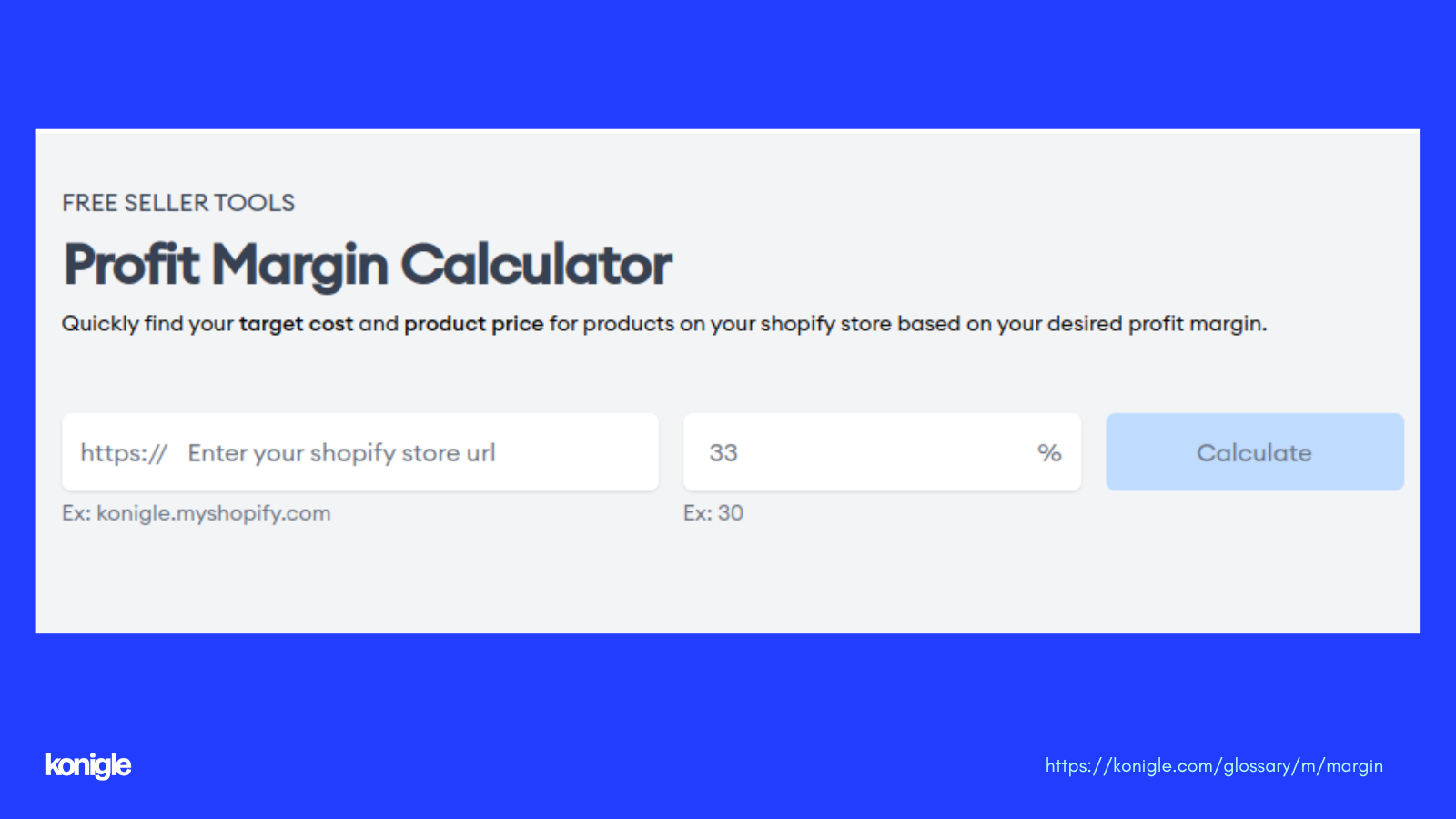

With the help of the Konigle profit margin calculator, you can easily calculate target costs for a given profit margin for your Shopify store.

What are the three types of margins?

There are several different margins commonly used by retailers to track. Every online store and product are different, and you will need to figure out good profit margins based on store or business.

1. Gross profit margins

The eCommerce gross margin is tracking the profit made after deducting the costs of the goods sold (revenues against the COGS). It does not include any other costs like expenses or shipping costs.

Formula to calculate the gross profit margins are:

Gross profit margin = Revenue - COGS/ Revenue * 100

2. Operating profit margin

The operating profit margin mainly calculates profit after factoring in overhead costs, including labor, rent, utilities, and administrative expenses.

Formula to calculate the operating profit margin are:

Operating Profit = Operating income / Revenue * 100

3. Net profit margin

The Net profit margins calculate the profit after subtracting taxes, interest and any other relevant expenses.

The formula to calculate the Net profit margin is:

Net profit margin = Revenue - Cost / Revenue * 100

Advantages and Disadvantages of Margin

Advantages of Margin

- This allows for increased leverage and the potential for higher returns on investment.

- This provides flexibility in borrowing and accessing additional funds for trading.

Disadvantages of Margin

- This increases the risk of losses and the potential for financial instability.

- Careful monitoring and management are required to avoid margin calls and the potential liquidation of assets.